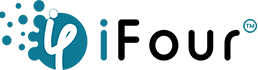

Microsoft 365 Copilot Use Cases in Fintech Industry

Microsoft 365 Copilot was made to help businesses work easier. That’s why tech leaders consider using Copilot with apps like Outlook, Word, PowerPoint, and Excel can:

- Save time

- Help create documents and presentations

- Make it easier to understand data

Let's delve further and check out the top Microsoft Copilot use cases in finance industry:

Use Case 1: Copilot allows you to automate your Financial Reporting

Fintech professionals, especially CFOs, often spend hours (even days) pulling data from multiple systems, validating spreadsheets, and formatting reports for management.

The risk of manual errors and version conflicts in their files further complicates the reporting cycle. This is where Microsoft 365 Copilot comes in.

Copilot Use cases in finance industry

By using MS Copilot in Excel or Power BI, fintech professionals can:

- Instantly pull in financial data

- Auto-generate reports

- Narrate trends using natural language prompts, and many more.

Whether it is weekly performance dashboards to build or month-end summaries to generate, Microsoft Copilot cuts hours of manual work into minutes of guided automation.

Best Practice of using Copilot for CFOs

You can use prompts like:

“Summarize revenue vs. expenses for Q1 in a visual chart”.

“Create a variance report comparing forecast vs. actuals for the past 6 months”

With this, you’ll not just get formatted insights, but also a clearer story to present to your Fintech stakeholders.

Use Case 2: Microsoft Copilot for Smarter Budget Forecasting

Traditional budgeting methods rely heavily on static spreadsheets, past assumptions, and disconnected teams. When market shifts occur, reforecasting takes weeks, which eventually delays your strategies and impacts agility.

How does Copilot for Finance help?

Copilot helps you enhance FP&A activities and enables you to build dynamic, data-driven forecasts just by analyzing historical data and applying predictive modeling techniques.

This is how various CFOs of Fortune 500s instantly explore different budget scenarios and adjust their strategy on the fly.

Best Tips for using M365 Copilot

Use scenario-based queries like:

“What happens to our EBITDA if operational expenses increase by 10%?”

“Forecast cash flow for Q3 based on last year’s growth trend.”

This lets you plan with confidence and respond faster to what’s ahead.

Image source

Use Case 3: D365 Copilot For faster Month-End Close and Audit Readiness

Month-end close and audits are among the most stressful periods for finance teams. Manual reconciliations, journal entry reviews, and audit documentation consume time and are prone to errors or oversight.

Solution: Microsoft Copilot for Finance Industry

Using Copilot in Dynamics 365 Finance, you can automate journal entries, flag inconsistencies, and generate clean, traceable audit reports.

This way, you can not only reduce time spent but also boost confidence in compliance and governance.

Best Practices of using D365 Copilot:

Enable Copilot to monitor journal entry flows and detect unusual activity. Use it to automatically generate audit trails and summaries with commands like:

- “List all unbalanced journal entries from the past 30 days.”

- “Create an audit-ready summary of expense entries for Q2.”

This makes the closing process faster, cleaner, and stress-free.

Use Case 4: Copilot for Finance is used for Vendor invoice processing

Finance teams often deal with hundreds of invoices weekly. For instance,

- Manual verification against purchase orders

- Approval of workflows that delay payments

- Increase in risk of duplicate or missed invoices, etc.

So, a solution like Microsoft 365 Copilot is essential to deal with these.

How does Microsoft Copilot benefit the Finance sector?

M365 Copilot, when integrated with Power Automate, can intelligently read invoice data, and validate it against matching Pos.

It can route it to the right stakeholder for approval. It also triggers timely payment reminders or flags anomalies before they escalate.

Here’s how to use Copilot AI in Finance industry

Use Copilot to set up intelligent automation flows like:

- “Match all received invoices to their respective purchase orders from this week.”

- “Alert me if any invoice over $10,000 is pending approval for more than 3 days.”

This accelerates accounts payable processes and strengthens vendor relationships.

Use Case 5: CFOs can generate Real-time Executive dashboards

Finance executives often lack access to real-time, decision-ready dashboards. They depend on analysts to compile and interpret data, which causes delays in strategic decisions.

Microsoft Copilot for Finance and FP&A

With Copilot in Power BI, executives or finance teams can generate performance dashboards by simply asking questions in natural language. Copilot understands context, fetches the right visuals, and builds dashboards on the fly.

Copilot Best Practices:

Empower decision-makers with voice/text prompts such as:

- “Show current revenue vs. target performance for each business unit.”

- “Summarize the top 5 expense categories this quarter in a chart.”

Now, your CFO doesn’t need to wait for weekly reports. The insights are ready when they are done this way.

Use Case 6: Using MS 365 Copilot for Compliance & Risk Monitoring

Ensuring financial compliance across changing tax codes, audit standards, and internal policies is time-consuming. Missed red flags can lead to penalties and reputational damage. This is where Microsoft Copilot helps.

Image source

How does Microsoft 365 Copilot secure data?

By monitoring transaction patterns, it can detect anomalies and even suggest control measures based on historical activity and the compliance rules you configured.

This way, Financial officers or leaders stay proactive rather than reactive.

Here’s how you can use Copilot:

Use Copilot to create automated alerts and reports, for example:

- “Highlight any transactions that exceed internal approval limits this month.”

- “Summarize risk-prone expense entries by department for Q1.”

This enhances your compliance posture and builds trust with auditors and stakeholders.

If you need help with Copilot security, just reach out to us. We can assist you in developing smart solutions with Copilot strategy and consultation.

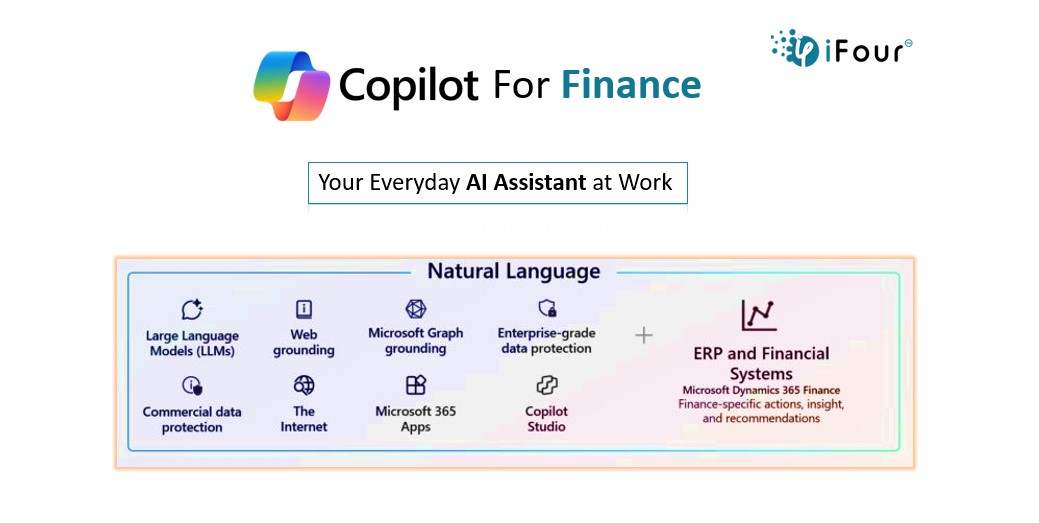

Use Case 7: Natural Language Data Queries for Finance Teams

Not every finance team member is comfortable using BI tools or writing formulas. This creates dependencies on analysts or tech teams for even simple queries.

Using Copilot for Finance industry:

With Copilot embedded in Microsoft 365 and Power BI, anyone can type or speak queries like “What’s our total revenue YTD?” and receive clean, reliable insights instantly — no technical knowledge required.

Here’s how you can use Microsoft Copilot:

Encourage team-wide adoption by using prompts like:

- “Compare Q3 expenses by category and show trend lines.”

- “List top 3 overdue receivables from enterprise clients.”

This democratizes data access and empowers every team member to contribute to strategy and operations.

So, these are the major use cases of Microsoft 365 Copilot for the Fintech industry. Hope you find this Copilot blog informative.

Require assistance in building AI agents? React out to us, and we help you build intelligent chatbots using our Virtual Agents consulting expertise.

If you need help creating AI agents, just reach out to us, and we can assist you in developing smart chatbots with our expertise in Virtual Agents.